This book is written by the author Morgan Housel, who wrote the best-selling book The Psychology of Money which explains our behaviour with respect to money and investing. As per the author, some behaviors or trends are inevitable and stay forever with respect to contexts such as events, emotions etc. Like the previous one, this book has 23 stories and each filled with fascinating data points and interesting anecdotes.

In next 5 min, we tried to summarize few of them and hopeful that you will come to know something interesting if you don’t have time to read 200 pages book or need glimpse before buying this book.

S6 # Best Story Wins

Good Stories have ability to motivate and evoke positive emotions, bringing attention to topics that people tend to ignore.

At the Lincoln Memorial on Aug 28, 1963, Martin Luther King Jr started his speech which was prepared by his adviser. But it was not going appealing & not going according to plan. Then King followed the suggestion of the Gospel singer, kept aside the prepared speech and told people about his dream, a dream deeply rooted American dream. The rest was history.

“It’s not what you say or what you do, but how you say it and how you present it matters.” – Yuval Noah Harari

If you have right answer and you are a good story teller, you will certainly go ahead like Mark Twin, Charles Darwin, Benjamin Graham, Winston Churchill etc.

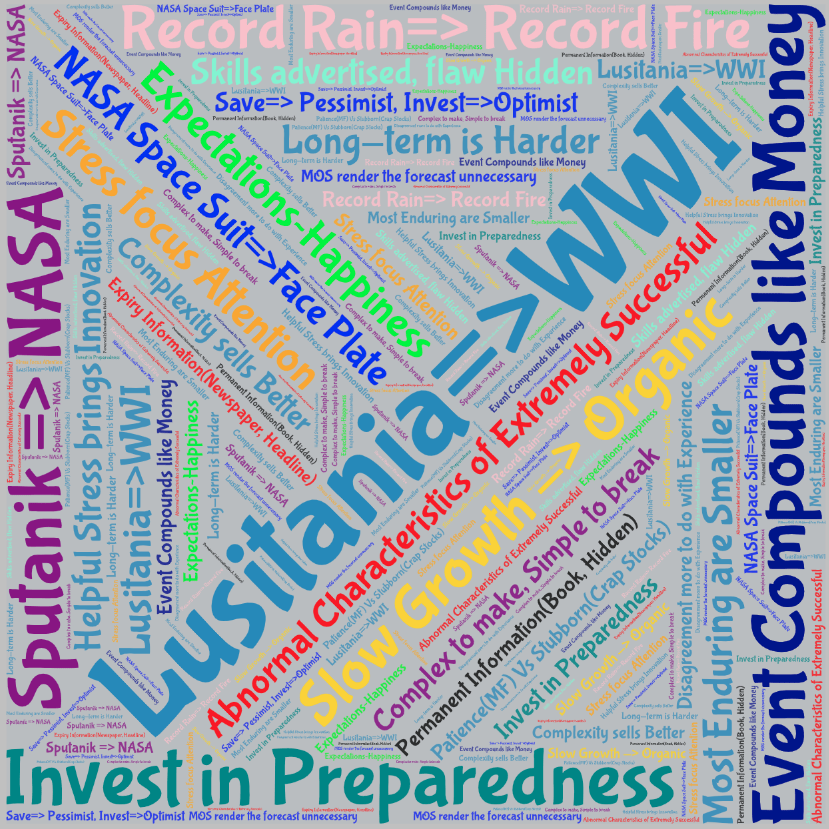

S1 # Hanging by a Thread

Every event, irrespective of size, has it's parents, grandparents, cousins etc.

The Captain of the Lusitania ship, which was travelling from New York, US to Liverpool, UK, shut down a fourth engine to save money in 1915. This engine shutdown delayed travel by one day, and would now sail directly into the path of German Submarine. The ship was hit by torpedo, more than 1200 passengers who were travelling lost their lives and triggered US to join WWI. Every big event could have turned out differently if a few little puffs of nothingness went the other direction.

Events compound in unfathomable ways like money.

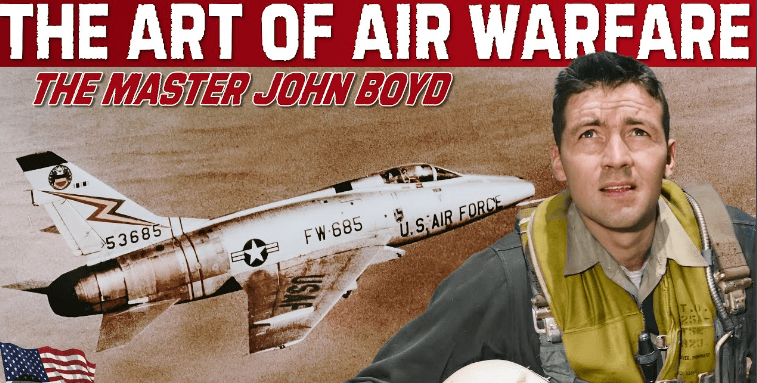

S4 # Wild Minds

Extremely Successful people have abnormal characteristics.

John Byod, was known as one of the greatest fighter pilots and influential thinker, who wrote a manual, "Aerial Attack study" at his twenties which became the official tactics guide of fighter pilot. But he was very arrogant, rude, impatient, disobedient etc. The Air force loved his insights but couldn't stand by byod.

“You gotta challenge all assumptions. If you don’t, what is doctrine on day one becomes dogma forever after”

S3 # Expectations & Reality

Everything is relative, and mostly relative to those around you.

The year 1950 is known as golden era for Americans from other eras because everyone earned a lower wage, lived in smaller homes, lack of healthcare as their neighbours, same camping as an adequate vacation. People weren't better off compared to now or other eras but they felt better off, because of social media absence, almost zero inflated expectations.

“The World is not driven by greed, it is driven by envy”: Charlie Munger

S2 # Risk is what you don’t see

In 1961, NASA was testing Space Suit in high altitude balloon flight by sending pilot Victor Prather to 113720 feet, the edge of the space. The flight was successful, the space suit worked but while descending back to earth, Prather opened the face-plate of his helmet to breathe fresh air. He landed as planned on ocean but there was a mishap, water rushed into his suit and he drowned.

“Invest in preparedness not in predication.”

S9 # Too much, Too soon, Too fast

You can't increase the size of a human and expect a similar percentage increase in performance.

Robert Wadlow was an American man who was the tallest person in history because of a pituitary gland abnormality. He was what friction would portray as a superhuman, capable of running and doing all sorts of sports than normal standard. But that was not true in his life. He required braces to stand, even walk. He paid a heavy price for excess growth in quick time.

“You can’t make a baby in one month by getting nine women pregnant”. by Warren buffet on quick profit.

Something similar happened to fall of Starbucks in 2008, when they started to open store in each four hours(2500/yr) ignoring the customer experience. Unnecessary expansion, diversification and acquisition create more headwind than tailwind.

S10 # When the magic Happens

Do you know the difference between helpful stress and crippling disaster?

The decade 1930-40 was known as one of the darkest periods in American History for obvious reason. But this period fuels the most innovation and increased productivity. Road construction went up to 6% of the GDP, which amplify productivity with less time to commute and increase car sale. Electrification extended to the rural places. First Supermarket & laundromat started during this time. WWII started with horseback but ended with nuclear fusion. This is an example of helpful stress where innovation blossoms, unlike crippling disaster.

“The excess energy released from overreaction to setbacks, is what innovates.” Nasim Taleb

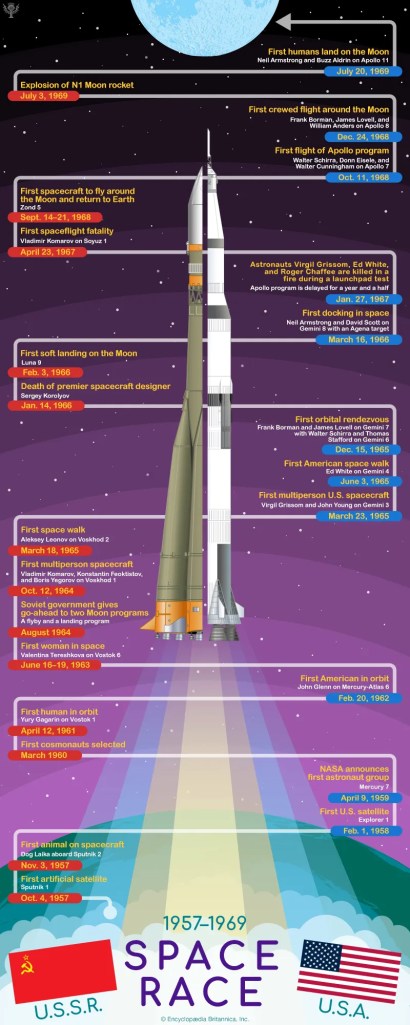

Similarly, many products & technologies came out of military camp as they deal with important, urgent and vital things and obstacles like money & manpower are removed. Establishment of NASA by USA was motivated by some kind stress of lagging behind when Soviet first launched Sputanik.

S13 # Elation & Despair

Combination of optimism and pessimism for sustainable growth. During 1984, Paul Allen wrote about 28-year-old founder of company Microsoft, who dropped out of college, Bill Gates when he met for the first time that He was really Smart, Competitive, and he wanted to show you how smart he was. And He was really, really persistent. He was a genius. But Paul didn't see the other side of Gates, Where he was paranoia. He insisted on having enough cash to keep the company alive for 12 months with zero revenue to avoid any uncertainty. So long term optimism and confidence exist with short term pessimism, which is known as depressive realism.

Save and plan like pessimist but invest and dream like an optimist.

S22 # Trying too Hard

The truth is Complexity sells better, looks exciting and steals lime-light but can backfire spectacularly.

In 2013 Director of the National Institute of Cancer, Harold Varmus explained How difficult the war was on Cancer and still seems perpetually distant. Despite advancement of technology and medical science, they have not succeed in controlling cancer as a human disease. Also he explained, we focus too much on treatment and not enough for prevention, which is simple, cost-effective, boring and can do better than complex treatment.

A trick to learning a complicated topic is realizing how many complex details are

cousins of something simple. John Reed

Similarly in finance, spending less than we earn, saving the difference and being patient is what we need to achieve financial freedom easily. In Health, sleeping eight hours, doing some exercise regularly and eat real food benefit us more than supplements and pills.

S8 # Calm Plants the seeds of crazy

After slapping Chris Rock on stage at the Oscars year, Will Smith asked for advice to Denzel Washington. Washington said: "At your highest moments, be careful. That's when the devil comes for you". This proves the Carl Jung theory named as Enantiodromia.

“Stability is destabilizing”- Hyman Minsky

Same happen to investment, when economy is stable, people get optimistic. When people get optimistic, they get into debt. When they get into too much debt, the economy becomes unstable again. And this cycle continues.

Do you how small mice defeated mighty tanks or how kidney operation different from investing? Then check 10 Real life examples.

Leave a reply to Thinking Fast and Slow – InvestOnSelf Cancel reply