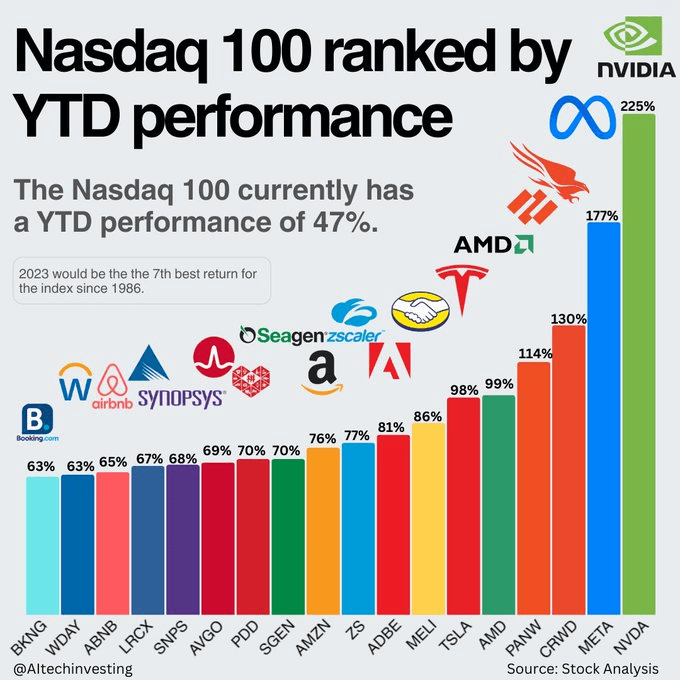

One tech company has been in the headlines for quite some time for its revenue growth (265%) and stock price gain (225%) over the years. But this was not the same bed of roses when this company was founded in the early 1990. Hardly anyone knew about the company and its product. It was on the verge of bankruptcy in 1995, when they released their first product. At that time semiconductor company giants, like Intel, ignored this nascent product segment and focused on their on-demand and money-printing CPU portfolio. But slowly and steadily the company focused on chip design in the gaming segment, offshored manufacturing and is now valued more than a trillion dollars.

Do you know the fastest pit-stop timing in an F1 race and why?

By 2023, on average, 18-24 pit crew members, each doing dedicated jobs, are required to give the fastest pit stop timing, i.e. avg 3.21 seconds, reduced from 67 seconds in 1950, similar to parallel computing.

Now, can you guess the company name?

The company designs graphics processing units (GPUs), known as NVIDIA where nv stands for next version and “idia” which is derived from a Latin word, means envy. Founded by three techies, two from Sun Microsystems and one from LSI Logic in 1993 over Denny coffee talk like “Chai Pe Charcha”. The company’s first product, “NV1”, known as Octopus, was a failure because it was a jack of all trades and mostly not suitable for the PC market, which was trending like hot cakes. But the founders envisioned the future demand and restarted updating the product accordingly.

Jab teen yaar mil jaayein (When three friends meet), it can be an all-night drinking or a million-dollar company.

Stay Hungry Stay Foolish

Context: CPU Vs GPU

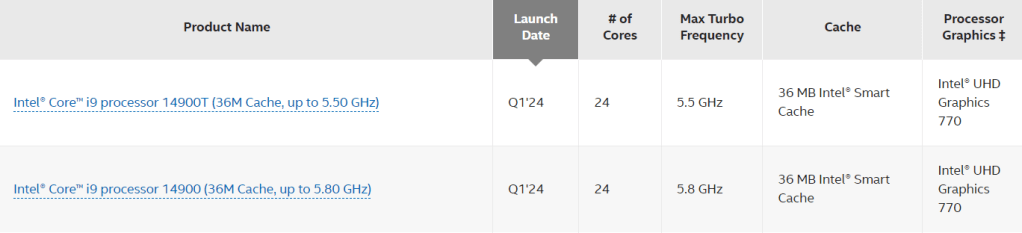

Central Processing Unit(# of Cores < 50): Does sequential processing of complex tasks. The CPU has few cores but a large cache memory. Processing units of this category are used for general-purpose computing.

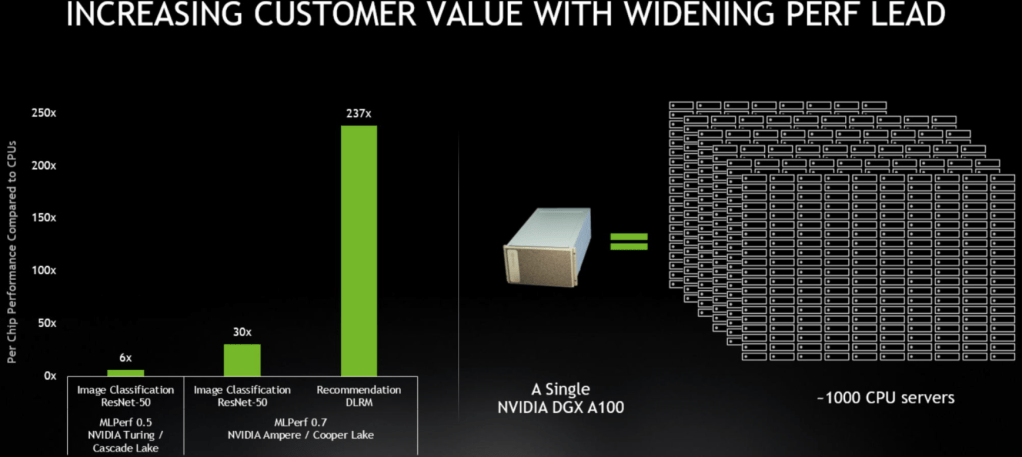

Graphics Processing Unit(# of Cores > 3000): Does parallel processing of tasks. It usually has hundreds (GeForce 16 series) to thousands (GeForce 40 series) of cores but small cache memory. Work faster, take less data centre space and consume less power to do processing simultaneously for abundant datasets. This is used for a specialised, specific feature.

Some key points in NVIDIA’s journey:

- Good past and contact: Got initial funding of $20 million from Sequoia using Huang’s contact in LSI Logic, where he worked.

- Full payment from their first client (Japanese) Sega Saturn saved them from bankruptcy after NV1 failure in 1995.

- Usage of a quadratic polygon instead of a triangle in the second product, “NV3 (RIVA 128)” to speed up rendering by reducing the processing workload with a lower number of polygons.

- The first big order was received from the Microsoft Xbox gaming console in 2000.

- AI, image recognition, speech recognition, neural networks, etc., research was neglected and discouraged by some advisers. Real Market didn’t exist.

- In 2012, AlexNet, which won the ImageNet Challenge with a 10.8% better result than the runners-up using Convolutional Neural Networks (CNN) with a GPU, created a revolution for deep learning. This experiment ignited markets like the Wright Flyer and Edison Bulb.

- Bitcoin mining, COVID-19 & ChatGPT fuelled demand growth towards the north.

- Company sold over ~500K A100 and H100 GPUs to Microsoft, Meta etc.

- Initially targeted a specific consumer segment, i.e. gaming, and then diversified.

- Quit the mobile segment, as their product was not suitable.

- Focus on the design of chips and not manufacturing. To save costs & spend more on R&D.

- Created an ecosystem with both hardware (GPU chips) & software (CUDA) which enables developers to explore.

- NVIDIA is way ahead with 87% market share in GPUs from its competitors. Adding another feather to the US economy and semiconductor dominance.

Which technologies thrive because of GPUs?

Generative AI, ML, Deep Learning, Image Recognition, Speech Recognition, Cloud computing, Video Streaming, LLM, Space Program, Genomics Sequential, Bitcoin Mining, Robotics etc.

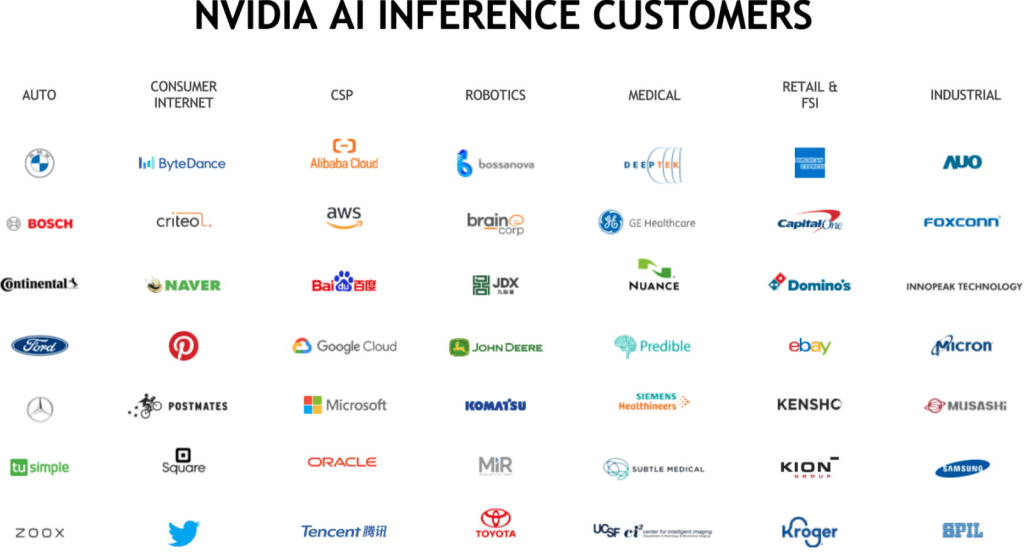

Do you know clients of NVIDIA’s GPU chip and their products?

Fan-out Clients:

Products:

AlexNet Neural Network, ChatGPT(NVIDIA A100), Google Gemini, Google Cloud, Google Deepmind, Google Lens, Google AlphaGo, Azure(NVIDIA A100), Netflix, AWS, Metaverse, Self-driving car(NVIDIA Tegra), Ray tracing gaming(RTX), Crypto, Super computer(TSuBAME), PS2, XBOX etc.

It is easy to understand why revenue growth & stock price skyrocketed for this company.

Fan-In Clients:

These below clients played an equally important role in the success of NVIDIA and its revolution for new products and technologies. Many companies would have faced very hard times if cutting-edge fab and its mass production were not in place, which brings chip production costs down.

NVIDIA’s GPUs are manufactured in TSMC fabs from the last three decades. And major & latest cutting-edge semiconductor equipment suppliers to TSMC are ASML for lithography machines, Lam Research for etching, Applied Materials for deposition and KLA for verification.

There will be follow-up posts for some of the fan-in clients. This is an attempt to capture some highlights with respect to the NVIDIA company.

How does content representation of a book help in creating a reading habit? Ease of Reading

Leave a comment