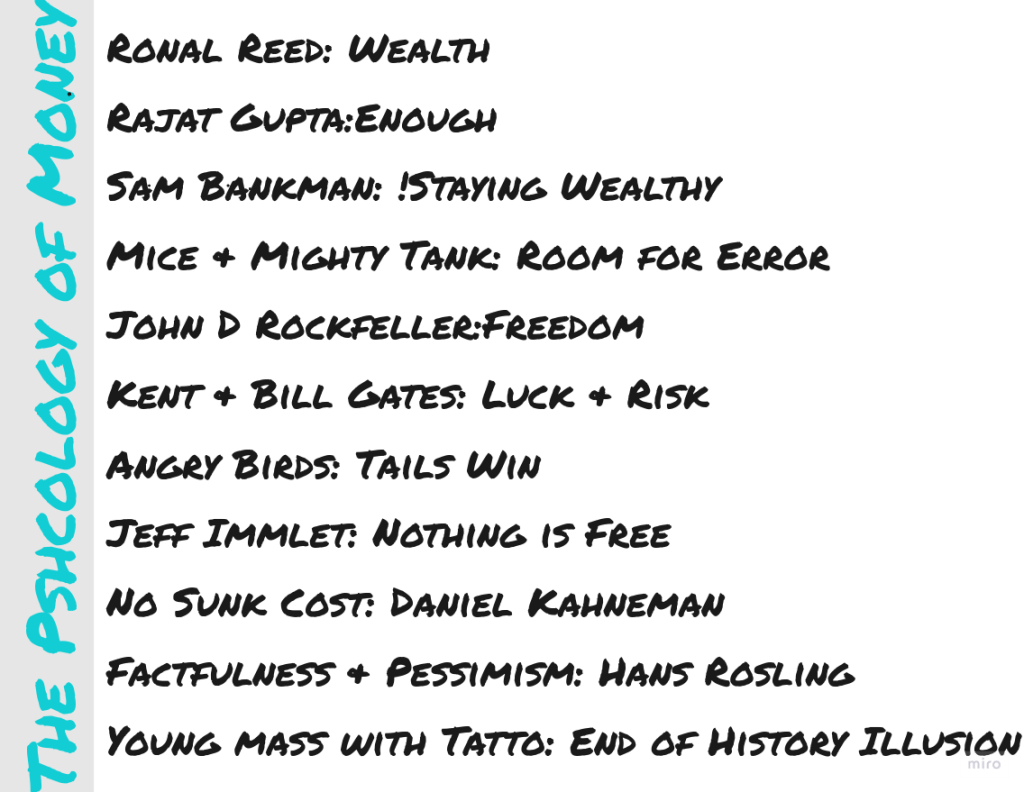

The book is filled with anecdotes, both related to the investing world and the non-investing world. Here are the top ten anecdotes that depict our behavior with money.

A. Mice Vs Tanks: Room for Error

Story: In WWII, the German army planned to use their superior tanks, and surprisingly, more than 100 tanks didn’t function. The reason was mice eating up the insulation protecting the electric system when these tanks were idle for some time before use. This use case never crossed the tank designer’s mind until then. Mice defeated the mighty tanks.

Unforeseen risks, uncertainty, and randomness are always inevitable. So we have to plan for our plan, which is not going according to plan.

B. 80–20 rule: Tails, you win

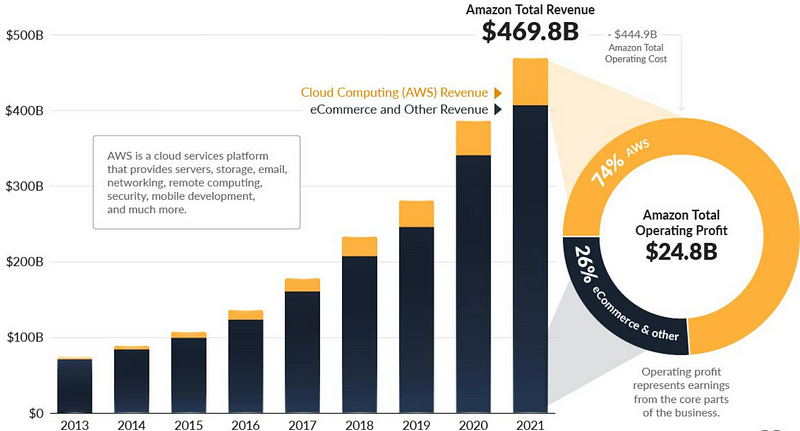

Story: In 1937, the first animated movie, Snow White and the Seven Dwarfs, literally saved (Walt) Disney, which was on the verge of bankruptcy after producing many failed ones. Similarly, AWS and online stores are tail events on Amazon, which experimented with a hundred of products, from the Fire Phone to a travelling product named Amazon Destination.

We try many things in life, but very few work out really well and drive everything. In short, 80% of consequences come from 20% cause.

C. Ice Age: Confounding Compounding

Story: There are many theories about the Ice Age and its extensive multiple layers of ice sheets in the Northern and Southern Hemisphere. The main reason for this is moderately cold summers and not cold winters, for which the ice sheet lasts long.

We don’t need a big amount or force to create something big. A small starting with consistency can lead to extraordinary result and defy all logic. Compounding happens over time, not instantly. The same reflects in the compounding interest formula.

D. Svah & Tathastu: Nothing is free

Story: Tale of two ex-CEOs of GE Co. Jack Welch was CEO from 1981 to 2001 and raised the company to $450 billion in market capitalization. But he always made sure quarterly results beat market expectations, irrespective of business and economy, for decades. Consequences of manipulation reflected in the next decades, crushing market value to less than half during the tenure of Jeff Immelt.

Give and take are tightly coupled and never one directional. We have to pay our due now or later, but can’t escape from it. The currency is not always dollar and cent. It is volatility, fear, uncertainty, greed, patience etc. which we overlook many a time.

E. Getting Wealthy Vs Staying Wealthy

Story: Michael Moritz, the head of well-knowned VC, Sequoia Capital, was asked how this company prospered for four decades unlike other VCs. And his reply was they have been afraid of going out of business because tomorrow won’t be like yesterday. We can’t be complacent.

Getting money requires taking risk, while keeping money requires the opposite of taking risk, fear and humility. The long term growth trajectory is up, but the road between now and then is filled with landmines.

F. Mind Vs Field Work: Freedom

Story: John D. Rockefeller, one of the most successful industrialists in the US, used to spend most of his time by himself, rarely spoke, and rarely did any work using his hands, unlike other field workers in 1870 (when 46% of jobs were in agriculture and 35% were in manufacturing). He was constantly working with his mind to think and make good decisions. Today it is switched. We are constantly working in our heads after our working hour, unlike a manufacturing worker.

Compared to prior generations, control over time has reduced. So controlling your time is the highest priority. Control over doing what we want, when we want, with people we want to, is the freedom.

G. Hard Science: Surprise

Story: Kidney operation is known as hard science because there is not much difference between how it operates now and a hundred years ago. But investing is not hard science as it is related to people and their preferences, which change with time, and change is the only constant.

We witnessed many surprises, like the Great Depression, World Wars, the housing bust in 2008, COVID-19, etc. and those are not the last, but we will witness more.

H. End of History Illusion: You will change

Story: Young people pay money to remove tattoos, where teenagers paid money to get them.

When we abandon the previous plan and feel like we have to run in a different direction to make up for the loss of the previous plan. So our journey focuses on direction, not speed.

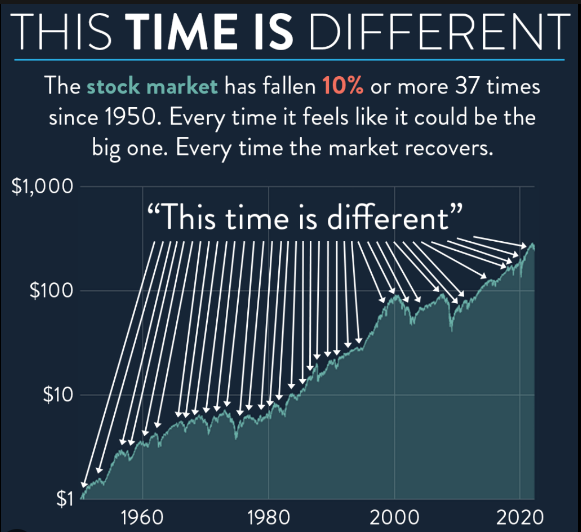

I. Instant vs Delayed: The seduction of Pessimism

Example: The stock market goes down sharply in quick time and becomes a headline to grab our attention. The opposite rarely happens.

Positive changes, like building a good habit, take months, years, and some time decades, unlike negative ones, which happen instantly. Many times, we are sceptical about good news and pay more attention to pessimism.

J. Hidden : Wealth is what you don’t see

Story: The famous janitor, Ronald Read, built an $8 million fortune with extreme frugality. He earned $50 in a week. His friends remember him driving a second-hand car and using safety pins to hold his worn-out coat together. He passed away in 2015, and then his estate was revealed to be worth a million dollars.

Wealth is hidden, unlike the outward appearance of the rich. So we often face difficulty exploring hidden wealthy ones. It does not matter how much money we earn if we are spendthrifts.

Do you know how to create good habits?

Then just click Atomic Habits.

Leave a reply to Money: Endowment Plans & Returns – InvestOnSelf Cancel reply