Do you know why we should not be complacent about success instead of staying grounded? Why are newspaper headlines presented with bold and customised fonts? Why do we go shopping during sale offer days? These behaviours have a reason. Let’s check some of them.

Regression to Mean:

The more extreme the original/first outcome, the more regression we expect because an extremely good result suggests a very lucky day. Overconfidence and the pressure of meeting high expectations often have a role to play. A few times a country won the consequitive World Cup.

Halo Effect:

The positive impressions of people in one area direct us to create positive feelings in another area for the same person, which may not be always true. We often feel that we know a person about whom we know very little. The horn effect is the opposite of this one.

Sunk Cost:

An investment (with respect to time, money, or energy) that has already been done and can’t be recovered in the future.

Priming Effect:

This is cognitive bias, in which one’s exposure to certain experiences influences their response to a subsequent action without any awareness of connection. System 1 provides impressions that often turn into beliefs and is the source of impulses that often become our choices and then our actions.

Priming bias works by activating an association with the environment consciously and unconsciously. Can you guess which seats are for elderly citizens in this picture below?

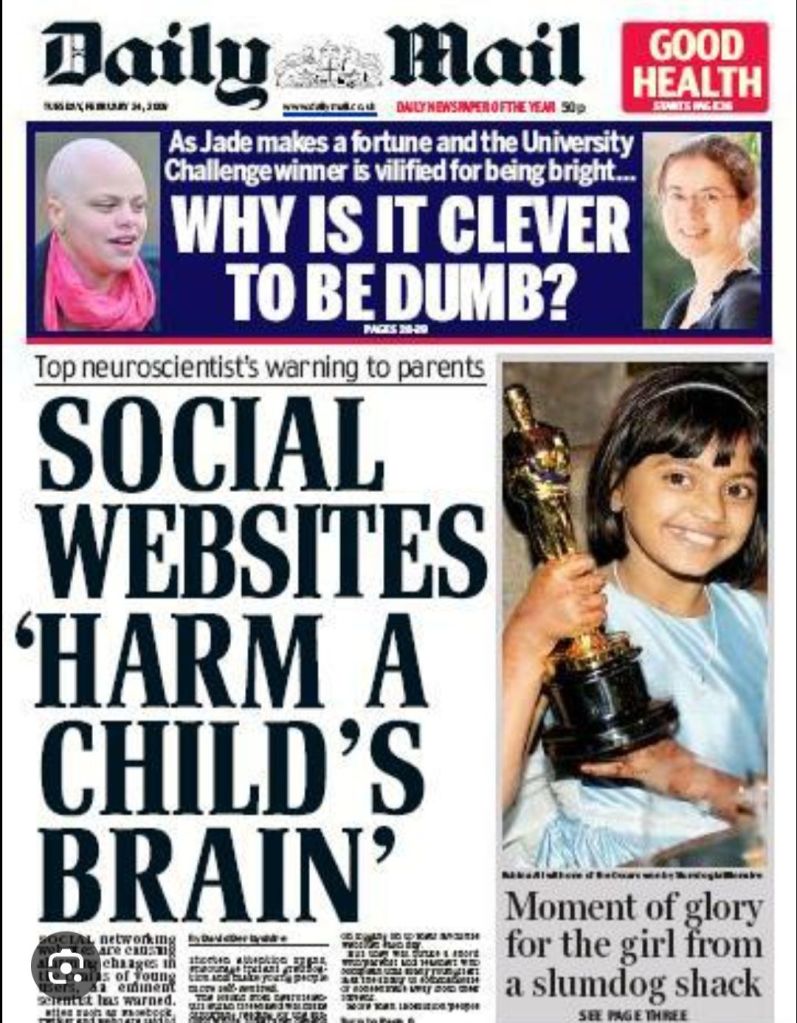

Cognitive Ease:

Cognitive ease reduces strain to gain attention with least effort, and that leads to a positive impression. Cognitive ease can be derived from many factors, for example: frequent repetition (same news over and over), experience of familiarity or past, easy representation. We can quickly go over headlines of newspapers and ADs, etc. because of customised representation, while it is not easy to finish reading this book, Thinking Fast & Slow, because the author wants our deep focus instead of shallow fragmentation.

Endowment Effect

The value of an item is directly proportional to its ownership. We value an item more when we own it physically and use it, unlike exchange. Brain scans also indicate that buying at a lower price is a pleasurable event.

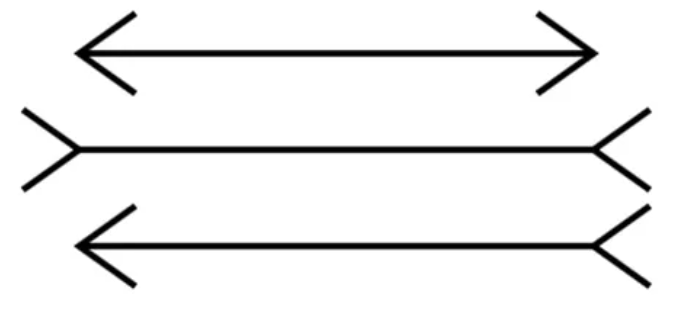

Muller-Iyer Illusion:

The optical illusion where two lines of the same length appear to be different. All illusions are not visual, but some are related to cognitive illusions too. To resist it, learn to mistrust our impression of the lengths of line when fins are attached to them.

Bernoulli’s Error:

The diminishing marginal cost of wealth is what explains risk aversion (people prefer a sure thing over a favourable gamble of equal or higher expected value). Emotion of excitement is more during the initial stage of wealth creation and then less towards the end. Similar trend with the taking risk. But this principle fails when we compare two people’s risk aversions who have different reference points.

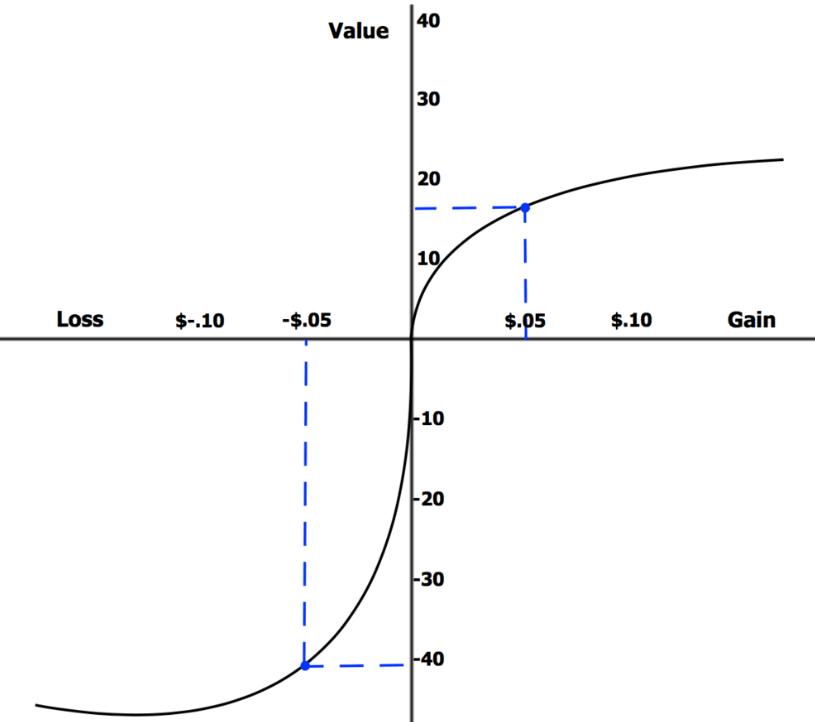

Loss Aversion:

The human emotion towards loss appears to be larger than gains. The pain of losing $100.00 is far greater than the joy gained in receiving the same amount.

System 1 leads the cognitive bias of the halo effect, the priming effect, the endowment effect, cognitive ease, and illusion. While System 2 is lazy and analytic.

Do you know what is common between extremely successful people? Or the difference between helpful stress and crippling disaster? then checkout Book: Same As Ever.

Do you like to know how to start fitness with running, then checkout 2024 Run.

Leave a comment