Do you know what the Dunning-Kruger cognitive bias means?

This is cognitive bias in which we, humans with limited competence in certain fields or domains, overestimate our competence or abilities. These fields or domains can belong to both primary and secondary skill sets. But with time and practice, when we gain experience and get hold of required skills, we achieve true confidence.

Idealistic Phase @ 20’s

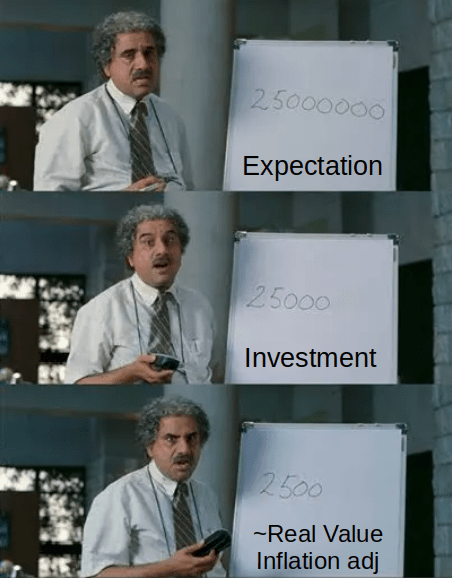

During early adulthood, young professionals (including myself) are just starting out in their professional careers with many hopes after completing their education. They think they can win all battles with the skill sets and tools in which they pass the exam. Sometimes, they dive into secondary skills (like side businesses, investing, trading, etc.), where they don’t have formal education, training, or prior experience. Many times, they underestimate the professionals in respective domains and their advice. More importantly, they overlook the margin of safety and look for instant gain.

We are no exception to it, like many of us. Although we were open to learning, we didn’t get proper guidance & direction. We dived into the secondary stock market to gain more profit. We were idealistic in the beginning with market buzz, friends input, etc., to achieve unrealistic gain and ignored room for error. Now, we have been holding our portfolio for more than 10+ years. Today when we value our overall portfolio performance, valuation (i.e., portfolio XIRR) is yet to turn green and is not able to beat market index returns when the market is making high after high. This is a kind of sunk cost fallacy.

Similarly, we invested in endowment plans for more than a decade with the expectation of guaranteed returns and doubling the money, ignoring the time period. You can find the reality of it in the below link.

Endowment Plan and Its Return.

Learning:

- Lost a good amount of time.

- Went in the wrong direction.

- Lost capital with no gain.

Every saint has a past.

Realistic Phase @ 40’s

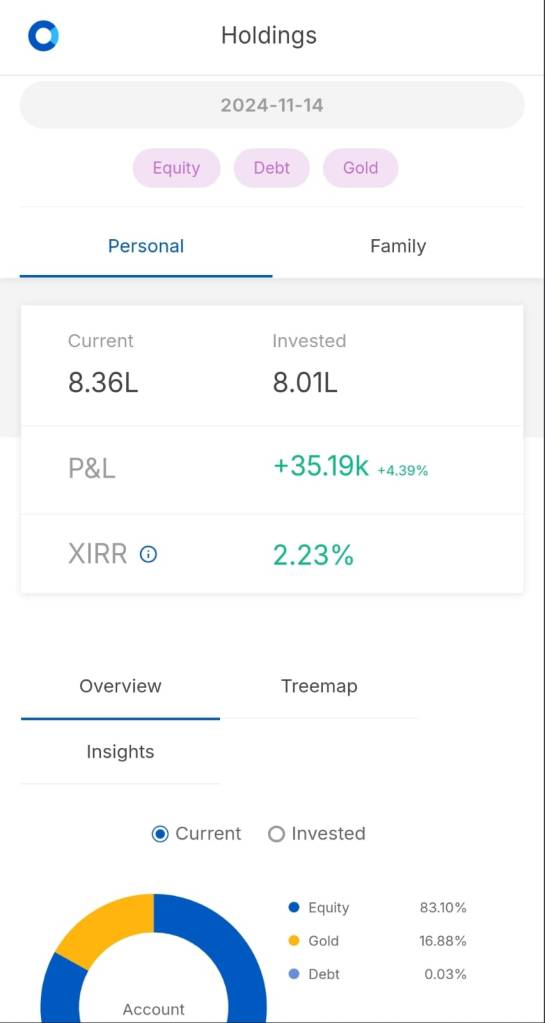

Like “Narada” enlightened the hunter “Ratanakar” to become sage “Valmiki”, we have realised our past sins the hard way and followed the long-term purist investor’s path. As we inch towards midlife transition with the reminiscence bump, we have started to rely on professionals with indirect investment (systematic investment plan) for realistic gain, unlike unrealistic high % gain on friends, news, and social media tips. Although we have invested in indirect investment recently, we can see the difference. Let’s not be overwhelmed with the graph, as tenure is small compared to previous tenure.

Benefits:

- Accept the reality and, more importantly, realistic gain.

- The primary goal is to beat the inflation and index.

- Don’t have to learn all the bits and bits of investing and monitor each day.

- Reduce a lot of stress and pain of staying up-to-date.

- Rely on professionals with reasonable fees and focus on our own primary skill set.

Idealistic at twenties, but realistic at forties. – Sudha Murthy

This may sound unreal for someone who has started recently after the recent COVID-19 crisis and witnessed only one side of the coin or for some experts who give full-time. Long-term investing is not easy because we, as well as our ecosystem, change with time, like young people who pay money to remove the tattoo; those teenagers paid to get it. So try to avoid the extreme ends of the financial decision.

Regrets are painful when you need to abandon a previous decision and run in the other direction to make it correct.

The Psychology of Money

Do you how small mice defeated mighty tanks or how kidney operation differnet from investing? Then check 10 Real life examples.

Leave a comment