This book needs no introduction as one of the best-selling books. It is all about behavior with money. The author of this book has an outstanding background in finance, which helps to explain and connect with real life examples. Without any further ado, let’s explore some key points of this great book, and I am pretty sure you will come to know something new. Note: Some pictures are added explicitly that may not be present in the book.

1. No One is Crazy

The environment plays an important role in decision-making. People who started investing during inflation or a market crash have different behaviors than during normal times. Also, the person on the news channel or your friends who are recommending you may not know your actual background, unlike you.

2. Luck and Risk

In 1968, 303 million people attended high school around the World. Only in the US, 18 million students did high school that year. In Washington, 270K students attended high school, and only 300 attended Lakeside Seattle School. Fortunately, Computer science was introduced in that school. Bill Gates happened to be one of the 300. And his classmate and Math prodigy, Kent Evans, who was equally talented, lost his life in a mountaineering accident. Both luck and risk are siblings.

3. Never Enough

Enough is not too little. Many rich people lost everything more valuable, like their reputation, freedom, family, friends, etc. in pursuit of getting more. So set your goal post and don’t move by doing just social comparison.

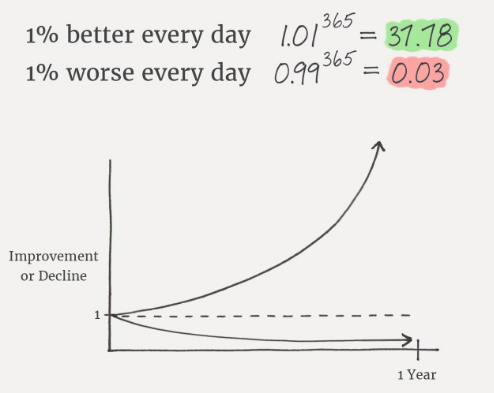

4. Confounding Compounding

Compounding happens over time, not instantly. Never interrupt it unnecessarily. Life is a marathon, not a sprint. Not only with money, but with any good habit, compounding gives exponential results over time.

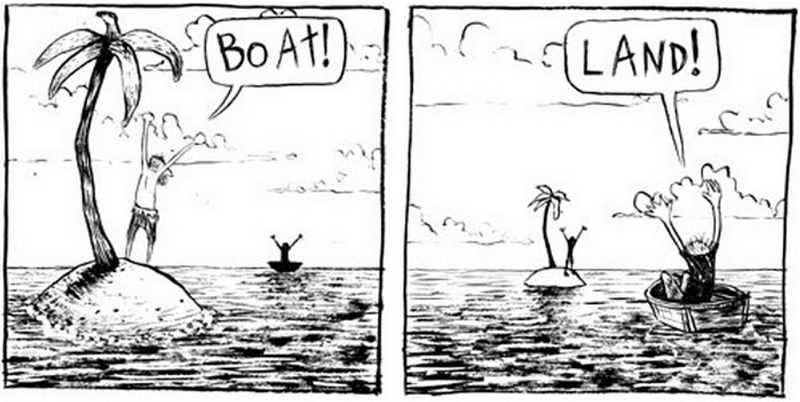

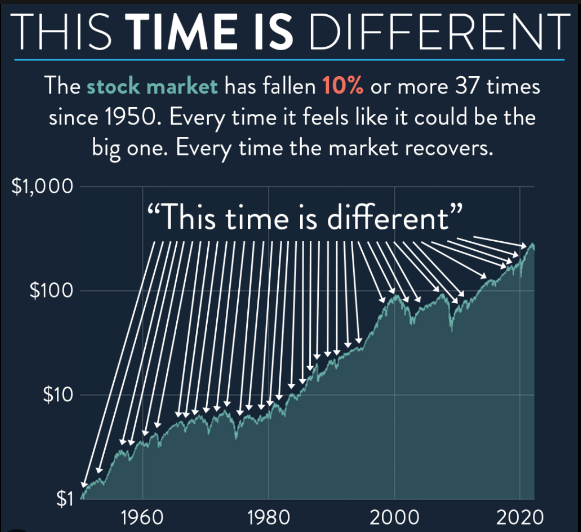

5. Getting Wealthy vs Staying Wealthy

Survival brings longevity. The road between now and then is filled with unknown landmines. So we and our investments need to survive all the ups and downs for years to get the benefit of compounding.

6. Tails, you win

We try many things in our lives, but we get maximum profit from very small things. It is sometimes known as the 80/20 rule, i.e., 80% of consequences come from 20% of causes.

7. Freedom

Compared to the previous generation, Control over our time has diminished as a large percentage of the workforce is not doing manual jobs like agriculture, manufacturing, etc. And we keep thinking about our work after office hours. Control over time is key to happiness, as kids don’t want your money (or what your money can buy), but instead they want you with them.

Freedom is, most importantly, whatever we want to do, wherever we want to do it, and with whom we want to do it.

8. Man in the Car Paradox

People mostly gawk at the luxury branded car, not the person who drives it. Humility, kindness, and empathy bring you more respect than the horsepower of luxury cars.

9. Wealth is what you don’t see

Wealth is hidden, unlike outward appearance of rich. So we often face difficulty to explore hidden wealthy ones.

10. Save Money

If we care less about others views, then we will desire less. If we desire less, then we will want less, and that leads to saving more. We don’t need a specific reason to save, as nothing is certain.

11. Reasonable > Rational

Trading is not rational for most investors, as it is very risky. But it is reasonable if a small percentage of the total portfolio is used, like curing mental disease by inducing fever in a specific range.

12. Surprises

Investing is not hard-science, i.e. kidneys operate the same way today as it did 100 years ago. We have witnessed many financial crises in the past and will face some in the future with different events. This is not a failure of analysis but failure of imagination.

13. Room for Error

Room for error is omnipresent, mostly in finance, and professionals accept it with humility and an incredibly conservative approach.

A person who forecasts with certainty, has many followers, while forecasting with perfect precision is next to impossible.

14. You will Change

Not easy to continue long term planning or investing, because we and our ecosystem change with time. Like Young people who pay money to remove the tattoo, those teenagers paid to get it.

Avoid the extreme ends of the financial decision. Regrets are painful when you need to abandon a previous decision and run in the other direction to make it correct.

15. Nothing is Free

Everything has a price, and we have to pay it now or later. In the investing world, currency is not always printed money (like Dollar, Rupee, Euro etc.), but it’s volatility, fear, greed, uncertainty, regret, ignorance, etc.

16. You and Me

Everyone plays a different game. When one tribe (investors) changes their strategy and starts following the opposite tribe’s (traders) strategy for lucrative short term gain, the time horizon of investment shrinks and bubbles form in the financial world.

17. The Seduction of Pessimism

We pay more attention to negativity and are skeptical about positivity. Three reasons for this behavior 1) Setbacks happen instantly unlike progress 2) Extrapolate current Trends 3) Impact on money.

18. When You will believe Anything

When the stakes are high, and you are desperately looking for a solution, but running out of options, you will just believe anything.

Finance is not a field of precision, unlike astrophysics, but it deals with human emotions.

Life is all about playing odds. Author’s investment strategy based on three important principle 1) High Saving Rate (with frugal habits) 2) Patience (for long term) 3) Optimism. This is an attempt to summarize some important points from the book written by the author Morgan Housel. We should not stop here, instead, read the complete book to get the most benefit out of it.

Do spend seven mins to read the summary of amazing Book Tata Stories to know fascinating facts behind each great Institutions.

Leave a comment