Some events are not isolated in globalization; instead, their impacts ripple through different parts of the economy and society. Recently, American Bank SVB, once ranked 16th and known as the best bank in February 2023 by Forbes, made headlines in the financial world. This is the consequence of some recent past events or decisions. This is not the first time a bank has failed, but for a different reason. Let’s look at the timeline and corresponding events to understand the reason behind this disruption.

Years & corresponding events:-

2020–2021 :

During this period, the supply chain was disrupted due to COVID-19, the Fed kept interest rates low, and the US government gave fiscal stimulus to boost growth for an unprecedented situation.

What It means? — High Liquidity & Supply Disruption.

This helped to boost demand (like housing, auto etc.) to an all-time high with household debt. Markets were going up. Start-ups got new funding from VCs and deposited it in banks (like SVB).

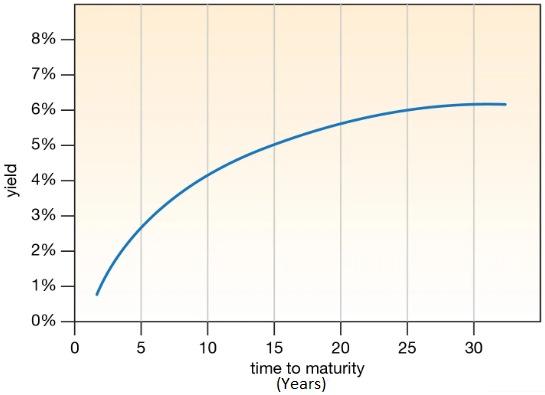

With a low interest rate, US Treasury Bonds (MSB) traded at a premium to par (and the yield on bonds was low). This indicates economic growth.

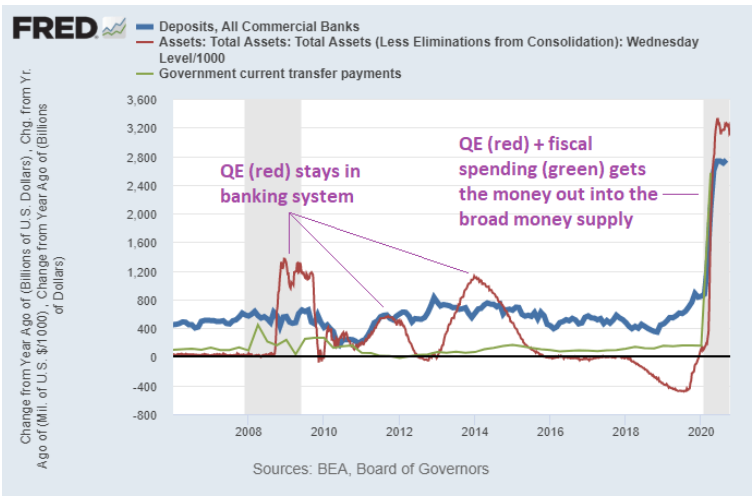

By late 2021, the US Central Bank, Federal Reserve System, said Inflation was transitory and did not take any action. Some economists criticized other countries that didn’t do money printing (= Quantitative easing + fiscal stimulus) like the US (printed $3 trillion in 2020), Japan, Europe, and other developed nations. The picture shows liquidity injected during 2008 and 2020.

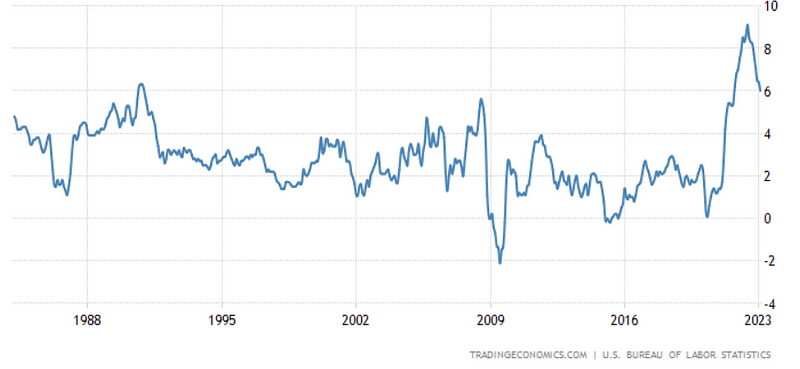

But Inflation was inevitable because of high liquidity and the mismatch between (high) demand and (low) supply-chain. In the US, inflation touched a peak during June-July 2022. You can feel the inflation in rising house-hold prices, utility cost, increase loan tenure, fewer savings, fewer investment with increased living cost etc.

SVB mainly dealt with start-ups & it’s ecosystem, and its clients were bulk depositors (83% of the deposit came from 37K depositors), unlike retail depositors. SVB deposits increased from $61 billion to $189 billion during this period, and SVB invested $80 billion (~43% of deposits) on long term MBS (HTM securities) bonds to maximize profit on short term deposits.

2022–2023:

To control uncontrollable inflation, US Federal Reserve System raised interest rate eight consecutive times rapidly, i.e. ~450 basis points only in 2022. Central banks can’t increase supply to counter high demand. So they did what they can, quickly in one year.

What It means? — Low Liquidity

Banks impact negatively because people/Companies try to avoid borrowing in high rate. The banks earn from the difference between the interest rate they receive on loans they make (asset), and the interest rate they pay for deposits (liability). With asset < liability i.e. banks cashflow turn negative & unstable.

Also, new funding scarcity led start-ups to get their deposits out from the bank to run the company (and burn cash) and start cost-cutting (i.e. Layoffs etc.).

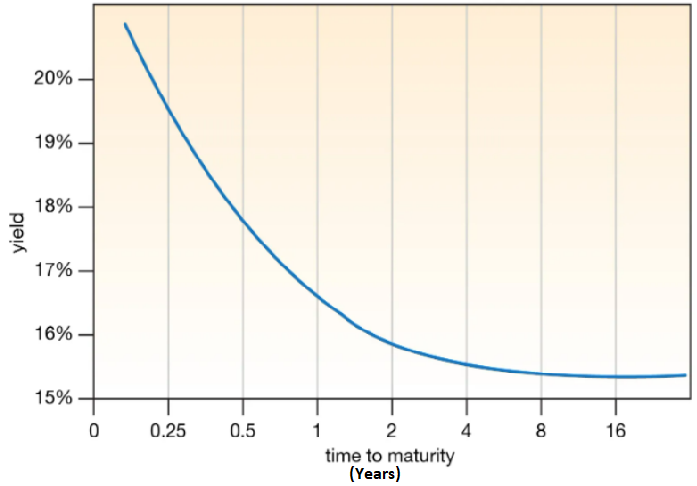

With high interest rate, price of US Treasury Bonds (MSB) traded at discount to par (and yield on bonds was high). This indication is not good for economic.

SVB’s investment on HTM securities became unrealized loss. Many other US banks(~200 small banks like SVB) have huge unrealized loss, i.e. ~$600 billion, declared by US govt.

More importantly, vulnerable banks (with asset-liability mismatch, bad loans, and mismanagement) start to fall and contaminate other similar banks. Central banks have a tough challenge to prioritize between growth and inflation.

Quick Events in a short span of time:-

On March 8, a cryptocurrency-focused bank, Silvergate Capital, announced bankruptcy. SVB sold their bond portfolio too early at a $1.8 billion loss. And in an interview, SVB’s CEO mentioned bank deposits were lower than expected.

On March 9, Silvergate panic led to more withdrawals by SVB depositors and bank cashflow turned negative. SVB failed because of an asset-liability mismatch (with short term deposits invested in long term bonds and then withdrawing them early) and needed a bailout.

On March 10, a bank run (behavior opposite to demonetization, where depositors deposit) happened to another 24-year-old, New York-based institution that lent largely to real estate companies and law firms, Signature Bank.

Similar bank failures and panics happened during 1932 the Great Depression, and the FDIC was founded in 1933 to insure deposit amounts up to $250,000. Many of SVB Bank’s deposits were uninsured by the FDIC (because clients deposited more than $250,000), unlike in 2008, when most deposits were insured. But the 2008 banking crisis was mostly due to loans that became bad loans.

Later, the US Treasury Secretary, FDIC and President came together to restrict the contamination and assure depositors that all of their money was safe. But a huge loss for SVB bond investors and equity investors.

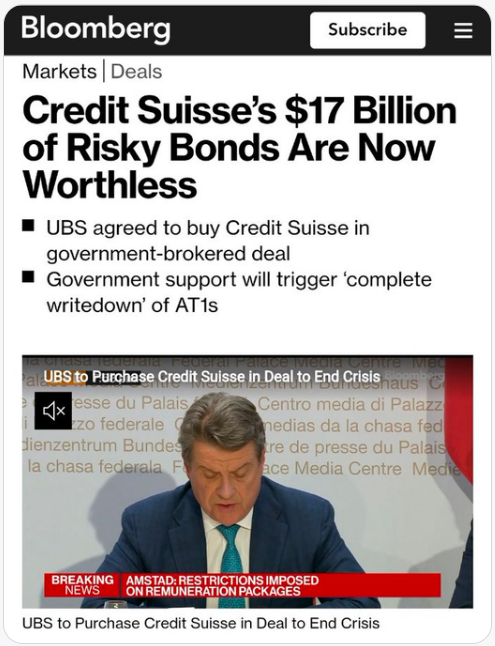

On March 16–19, despite recent turmoil, the ECB raised rates by 50 basis points to curb inflation. Another regional bank, First Republic, tumbled, and capital was infused by other banks and the central government to prevent collapse. On the same weekend, another financial institution’s story unfolded. UBS took over its rival Credit Suisse (a 167-year-old Swiss bank with 50K employees all over the world and a net worth of ~$8 billion until March 17, 2023) for just over ~$3.2 billion (60% less than the company’s value). Immediate steps were taken to prevent another big bank collapse. Credit Suisse’s $17 billion of risky bonds are worthless. Once known as the “Safe Heaven” of rich clients, it started searching for its own place because of a string of scandals, corruption, mismanagement, and bad strategies.

Next Events to watch out:

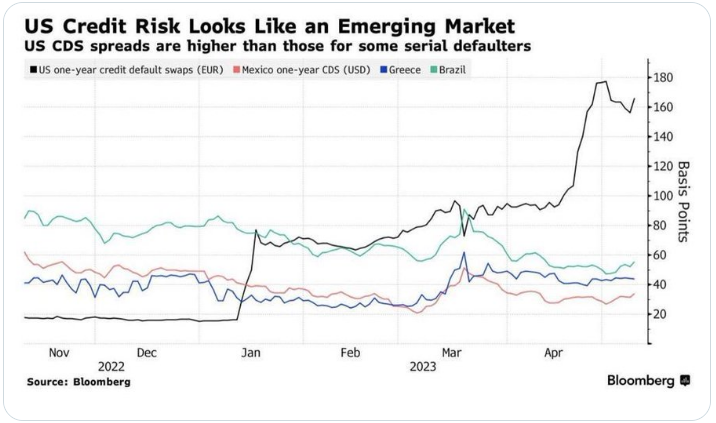

Unlike the big US banks, which have diversified their portfolios, SVB dealt with only the start-up ecosystem. So Long Winter is coming for many startups in different countries like the US, UK, Europe, China, India, etc. after the collapse of SVB. Clients, service providers, and employees of companies may be impacted. Credit default swap of biggest Economy, US, with other emerging economies.

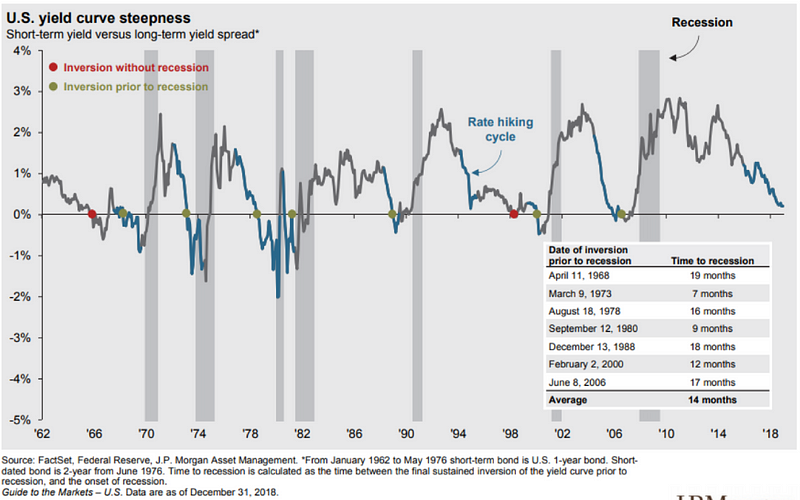

In the history of the inverted yield curve, 7 out of 9 such situations indicate pain for the economy and the market in the coming days. So we need to be watchful about the coming days.

We need to watch the central bank’s action in the coming days with respect to current challenges and its future roadmap.

Growth, which is driven by compounding, takes time, while destruction is driven by single-point failures, which can happen in a short period of time.

Read More History and fewer Forecasts. — by Gautam Baid

Disclaimer: I am an amateur in this field but curious to understand the reasons behind disruptions, falls, and related events.

Reference:

https://www.nasdaq.com/articles/money-printing-and-inflation%3A-covid-cryptocurrencies-and-morehttps://www.nasdaq.com/articles/money-printing-and-inflation%3A-covid-cryptocurrencies-and-morehttps://www.nasdaq.com/articles/money-printing-and-inflation%3A-covid-cryptocurrencies-and-morehttps://www.nasdaq.com/articles/money-printing-and-inflation%3A-covid-cryptocurrencies-and-morehttps://www.nasdaq.com/articles/money-printing-and-inflation%3A-covid-cryptocurrencies-and-morehttps://www.nasdaq.com/articles/money-printing-and-inflation%3A-covid-cryptocurrencies-and-more

Leave a comment