If you have an endowment policy (ICCI Pru Saving Suraksha, SBI Life Shubh Nivesh, ULIPs, mainly LIC policy etc.), it’s still active & you are paying premium, then you should read till end & check annualized returns of yours policy.

Note: Endowment Policy = Investment + Insurance + Tax Saving

During the start of our professional career, we do invest in different plans, mostly endowment plans to save tax (which is the last objective of any endowment policy). We were approached by parent’s friend or friend, or distant relatives with buzzwords & big number, like sum assured 5 or 10 times, guaranteed returns, life cover & and tax saving. We don’t even remember their names after some time, but we have been investing by paying annual premiums just before the tax assessment year. Sometimes, these policies annual returns are not enough to beat inflation, although they have accident & death benefits. And we all have at least one or more of these in one form or another.

Do you know the annualized return of your endowment policy?

A bouquet looks beautiful with different types of flowers, not a policy which serves multiple purposes.

With some basic knowledge, let’s see returns of some of these policies with respect to its category. And update our future investment plan accordingly.

There are different instruments to calculate returns on our investments like absolute return, CAGR, XIRR (IRR). You can find many similar plans online in each category.

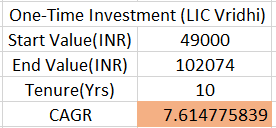

Lump sum Investment:-

CAGR is the best instrument to calculate returns where no multiple cash flows are involved, i.e. frequency of payment is only one as it signifies in its name.

There can be many different plans in this category with different AMCs. We did a similar one by paying a one time premium for LIC Policy and hold it for 10 years to mature.

Don’t just consider absolute returns (double), but also think of the Time period.

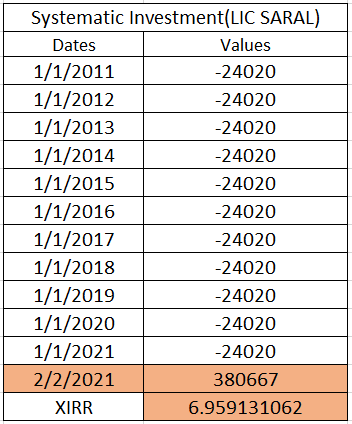

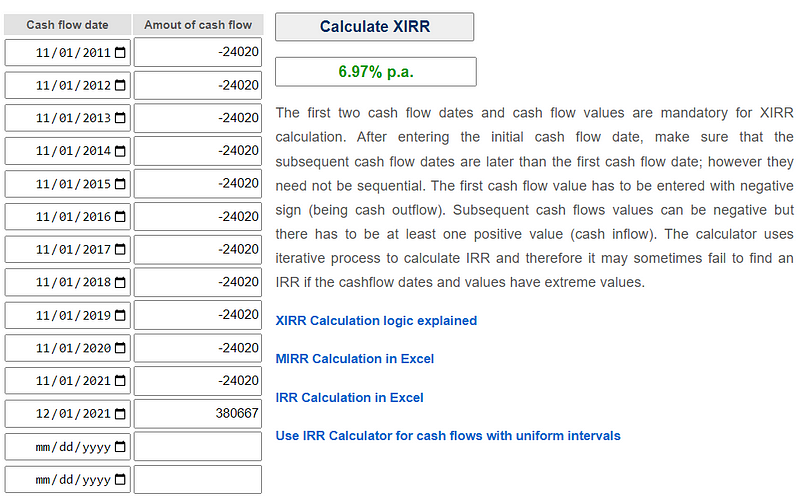

Systematic Investment:-

XIRR is the best instrument to calculate returns where multiple cash flows take place over the years. You can find XIRR rules in MS Excel to calculate your policy return.

We enrolled for one endowment plan and paid premiums systematically over 10 yrs out of 20 yrs and withdrew the amount on 10th year itself (minimum tenure). Negative Numbers are premiums paid over the years and a positive number is the end value (i.e. maturity value).

In short, with no financial awareness & after decades of disciplined investing, annualized return is around 7% or ~8%. And we can improve this return for the next upcoming decades with a little more awareness & specific plans for specific goals/purposes.

By the way, do you know How LIC earns money to give this return?

Frankly speaking, we didn’t think through it for the following reasons:-

- Less Financial awareness/knowledge

- Financial Background

- Trusted Relatives, but unknown Policy Advisor

- No time in Busy schedule

- Exchange Offers (like you have to buy an endowment plan to get Bank Locker* & this helps to achieve target etc.)

Disclaimer: Consult your investment advisor & invest as per your situation/condition. No intention to defame any particular policy or plan here.

Do you know, What is the realistic Investment Strategy & Why?

Then click on this link, Idealistic Vs Realistic Investment

Do you know, how small mice defeated mighty tanks in WWII?

Then click on this link, 10 real-life example from the psychology of money.

Leave a comment